In a general sense, ‘digital transformation’ could be described as transitioning customers who do not use digital technologies into those who do. When it comes to banking, certain technologies, like mobile banking and contactless payment, have been on the cusp of breaking through for some time.

Now, after months of stay-at-home orders, new digital habits are starting to solidify in customers and these behavior shifts are uncovering more nuances into audiences.

But before we start proclaiming “the death of the branch” or “the end of cash” we need to remember that the strategy to get to digital transformation is still not a one-size-fits-all solution. Both comfort of your customer base and company capabilities need to be considered.

This new digital audience segmentation is intended to define audiences as well as provide a benchmark to begin thinking about how to best map out the path to digital transformation, starting with the customer behaviors first.

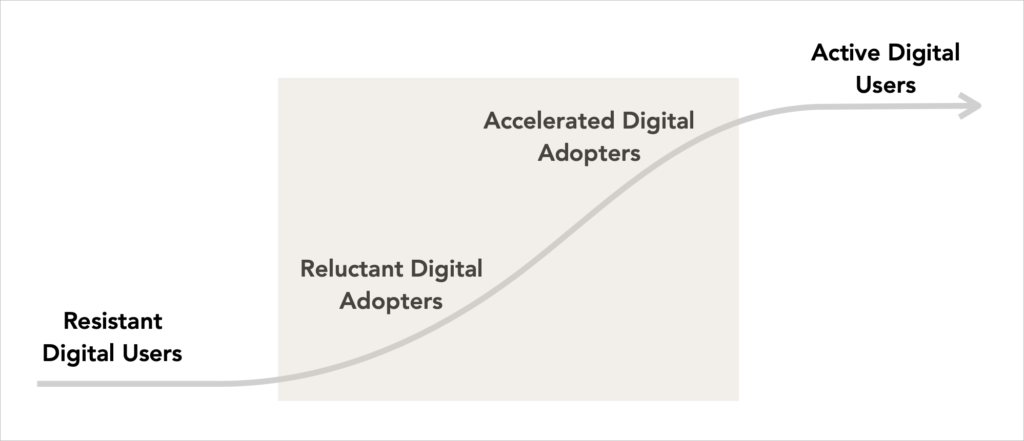

Digital banking audience segments

By segmenting audiences by not only their use of digital technologies prior to COVID-19, but also by their changes in behaviors during the pandemic, unique digital audience profiles begin to emerge.

- Resistant Digital Users: Slower adopters of technology and non-users of digital banking platforms

- Reluctant Digital Adopters: Slower adopters of technology that have now become first-time users of digital banking platforms

- Accelerated Digital Adopters: Early adopters of technology that increased usage of banking platforms during the pandemic

- Active Digital Users: Early adopters of technology and frequent users of digital banking platforms