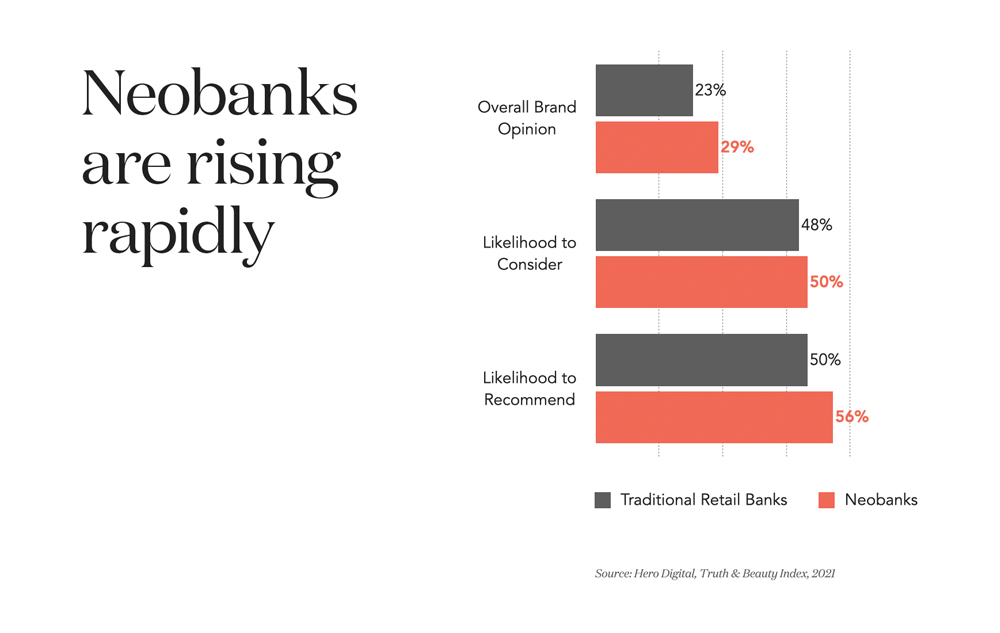

The rise of neobanks highlights a rapid change in the financial services industry.

Using mobile technology and remote agents to provide 24/7 online services, neobanks are changing customer expectations. By revolutionizing the concept of convenience and connecting with customers in new intimate ways, these organizations are poised to challenge traditional banks.

Financial services leaders must transform their business strategies to meet the increasing demand for empowerment, shared values, and guidance.

Winning the future battle against this new breed of banks requires strategic digital transformation. Traditional banks must examine what’s driving customer advocacy and create digital experiences that connect with today’s financial services customers on a human level.

This Financial Services CX Snapshot showcases what financial services customers value most about neobanks and the customer experience initiatives that traditional banks should prioritize to win in the future.

Download the full report to win the battle with neobanks and connect with today’s banking customers.

Frictionless App

Deliver a frictionless digital experience from anywhere.

Biometric Security

Leverage biometric technology to increase security while also making access easy.

Rapid Onboarding

Get people started in seconds.

Intuitive Guidance

Open up new financial opportunities.