Financial services companies that are customer-obsessed will rise above the competition and thrive.

Everyone wants to know what customers want. In the digital age, the dictum has turned its head: customers expect that you know what they want, and can deliver it to them seamlessly.

Financial services organizations face this challenge amid generational disruptions, volatile geopolitics, and record inflation upending economies and battering customers clamoring for stability.

Traditional financial institutions must improve their customer experiences before falling behind fintech and other competitors, while all firms should pace the needs of Millennials and Generation Z, who bank differently than their parents.

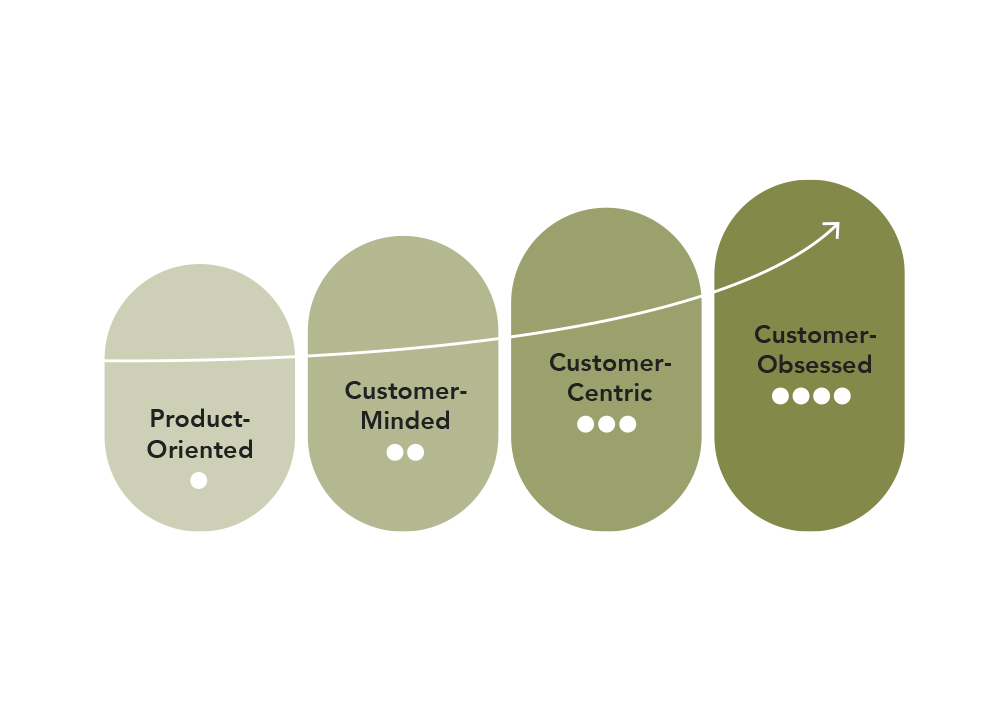

In this environment, only customer-obsessed companies can thrive. While there isn’t a magic customer-obsession switch, there are formulas that can set you up for success. Companies that embrace test-and-learn strategies will accelerate their customer focus, driving customer obsession through experimentation.

Hero Digital’s Financial Services Customer Obsession Report helps business leaders discover the needs of the people they serve.

Read this report to discover tangible strategies for accelerating your customer focus, creating bullet-proof value for those you serve, and building test-and-learn systems everywhere in your company.

Listen to customers, regularly

Every interaction is an opportunity to record feedback, implicit and explicit.

Pivot swiftly and fearlessly

Changes are not failures, but steps along the path to discovery.

Have clear internal alignment

Every employee is aligned to serving customer needs.