Embrace privacy to create a powerful and secure customer intelligence ecosystem.

Financial services customers are intrinsically privacy centric. They’re not willing to share their valuable personal information easily. Transparency and consent are essential for gaining their trust.

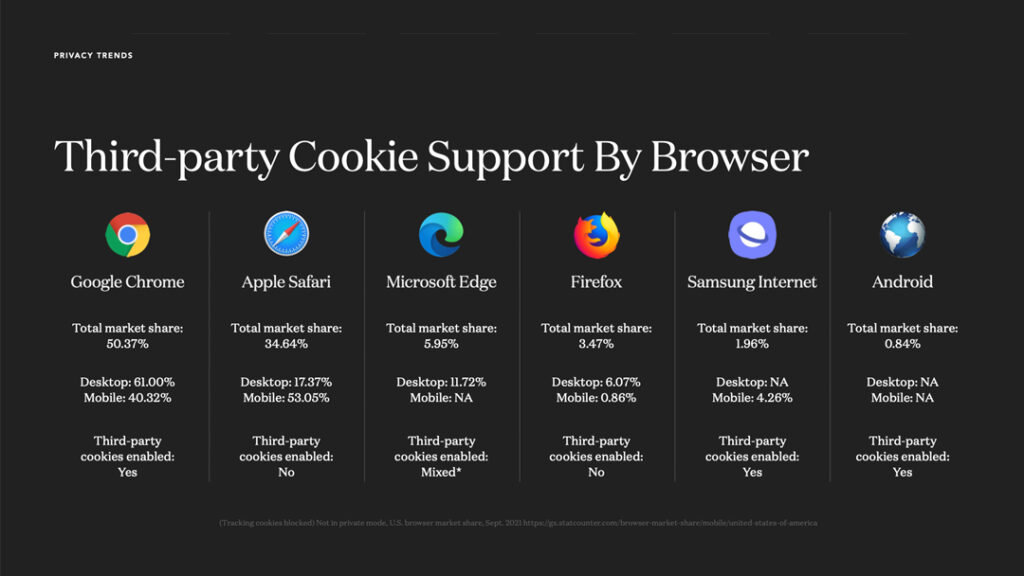

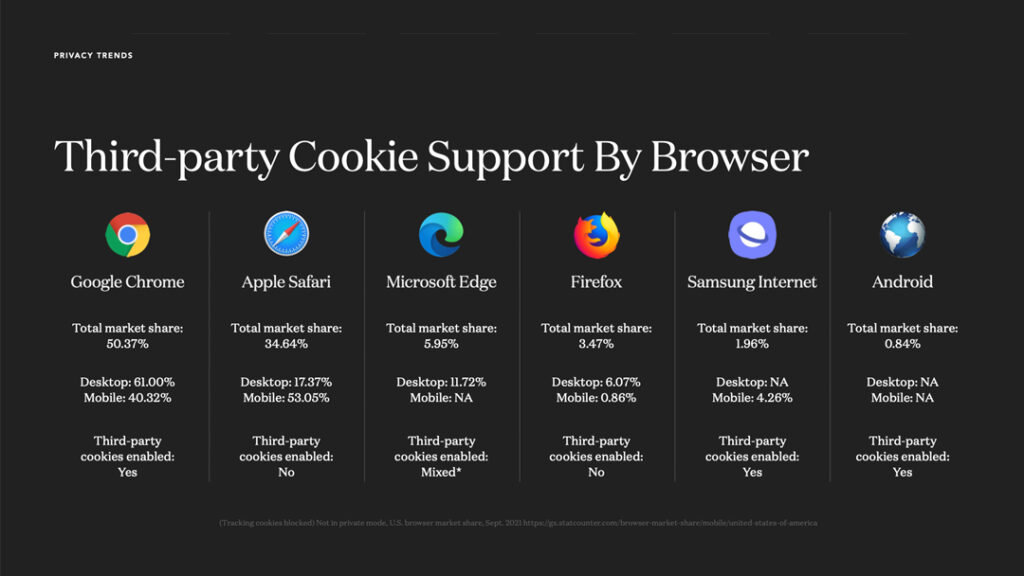

In this new era of privacy, every brand is now a data company. Marketing strategies that rely heavily on third-party cookies are disappearing. Serving targeted ads and personalized content to prospects and customers is going to be challenging.

When personal data is harder to obtain, customer intelligence becomes more valuable. It’s important to develop digital transformation strategies that boost your ability to collect and utilize first-party data.

It’s time to welcome a new era of privacy. Leading financial services companies are embracing the end of third-party cookies with new levels of transparency and authentic conversations. To succeed, every company must discover new, genuine ways to collect data and gain insights into their customers.

Hero Digital’s Financial Services Cookieless Future Report highlights new, genuine ways for financial services companies to collect data and gain insights into their customers.

Replace third-party cookies

ID replacements like TTD Unified ID 2.0 or LiveIntent nonID

Get first-party data

Use your CRM/back-end systems data on your customers

Maximize first-party data

A Customer Data Platform (CDP) to segment users and personalize digital experiences