Successful digital transformation outcomes come from making the right choices for your business based on what matters most to your customers.

Hero Digital’s Financial Services Customer Experience Index illuminates key takeaways from four generations—Gen Z, Millennial, Gen X, and Boomer—and three industry sub-sectors—Retail Banking, Investing, and Mortgages.

Digital transformation is accelerating across every sector of the financial services industry.

Neo-banks are challenging traditional banks, investing is becoming decentralized, and new cryptocurrencies are being created every year. Mobile banking, payment, and money transfer platforms are now the norm and the economic impact of the pandemic has pushed people to solutions that help them stretch their budgets.

At the same time, uncertainty, extreme volatility, and financial complexity are increasing the pace of regulatory change. Financial services companies must transform their business strategies to meet the increasing demand for privacy and control. This begins with understanding the individuals on the other side of the screen.

This new financial services report lets you understand the human truths that drive both brand choice and brand advocacy.

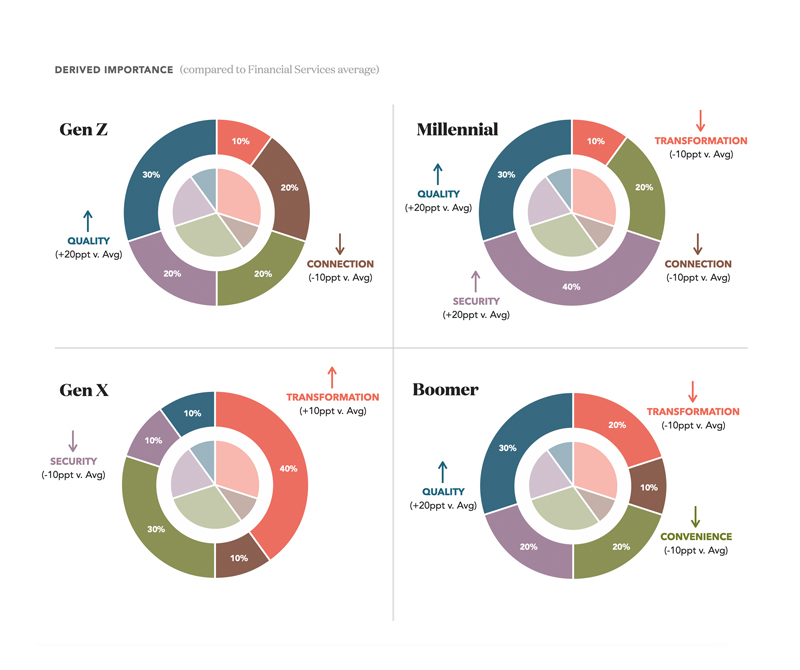

Gen Z

20% of Gen Z customers rank ease and access as top customer experience attributes when recommending a financial services company.

Millennial

40% of Millennials rank privacy and trust as top customer experience attributes when recommending a financial services company.

Gen X

40% of Gen X customers rank empowerment and disruption as top customer experience attributes when recommending a financial services company.

Boomer

30% of Boomers rank price and stature as top customer experience attributes when recommending a financial services company.